Content

Even though the cost of the asset has been made already, it isn’t yet an expense in the financial records. They transform into an expense during a later accounting period . The adjusting journal entry is done each month, and at the end of the year, when the insurance policy has no future economic benefits, the prepaid insurance balance would be 0. Prepaid insurance payments are made in advance for insurance services and coverage. According to generally accepted accounting principles , expenses should be recorded in the same accounting period as the benefit generated from the related asset. When the periodic payments are structured so they can not be calculated without the occurrence of an event, such as a number of sales or units produced, the payments are not considered fixed rent.

- Means any rent that is not fixed rent, including any amount reflecting an adjustment based on a reasonable price index (as defined in paragraph of this section) or a variable interest rate provision (as defined in paragraph of this section).

- E. No nonresident property owner shall maintain an action in the courts of the Commonwealth concerning property for which a designation is required by this section until such designation has been filed.

- A local government or other political subdivision of this State shall not deem there to be a nuisance or take any other adverse action against the landlord of a dwelling based solely upon the tenant or another person in the dwelling of the tenant requesting emergency assistance in accordance with subsection 1.

- Accounting automation software streamlines processes, reduces errors, and makes accounting teams stronger.

- 20% of the asset’s original cost should be represented by the residual value.

The January month-end income statement reports $1,500 as the current period insurance expense. Every month, the journal entry further decreases the prepaid expense account balance as the value of the coverage period is recognized by the business. B. If the landlord fails to provide the notice required by this section, the tenant shall have the right to terminate the rental agreement upon written notice to the landlord at least five business days prior to the effective date of termination.

How to File Business Taxes for Your Small Business

Energize your accounting team by creating capacity with automation. Invest in your future by unifying and automating accounting work. Save time and cost, decrease risk, and elevate the organization. Enable greater collaboration between Accounting and Treasury with real-time visibility into open transactions. Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital. Seamlessly integrate with all intercompany systems and data sources.

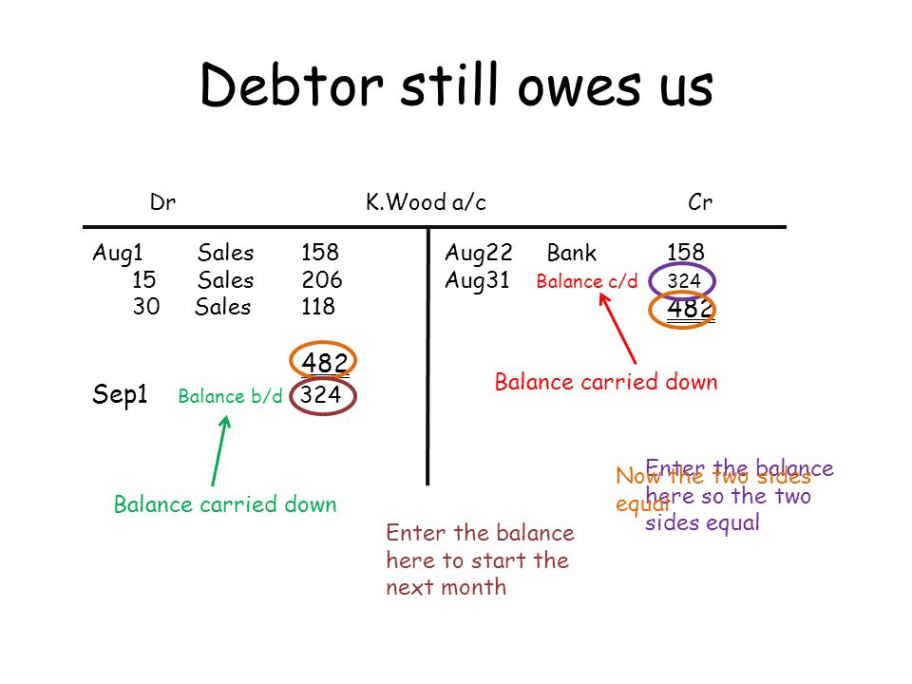

What is the difference between rent expense and prepaid rent?

In layman's terms, the difference is simple: A rent expense is the amount you have to pay under a lease agreement, and prepaid rent is any rent expense that you pay in advance of the due date.

A landlord shall disclose in writing to a prospective tenant if the property to be leased or rented is the subject of any foreclosure proceedings. The notices shall be kept current and reasonable efforts shall be made to maintain them in a visible position and legible condition. Notify his or her successor in writing that the landlord has returned all such security deposits or portions thereof to the tenant. Return to the tenant the portion of the security deposit remaining after making any deductions allowed under NRS 118A.242. The claim of a tenant to a security deposit to which the tenant is entitled under this chapter takes precedence over the claim of any creditor of the landlord. Charges which may be required for late or partial payment of rent or for return of any dishonored check.

What is the Purpose of a Prepaid Expense?

In some instances, Prepaid Rent Definition And Meanings to pay an entity for the use of their asset may not fall within the scope of ASC 840 or ASC 842, but payments for these contracts may still be recorded as lease or rent expense on the lessee’s income statement. When rent is paid in advance of its due date, prepaid rent is recorded at the time of payment as a credit to cash/accounts payable and a debit to prepaid rent.

Respective responsibilities of the landlord and the https://personal-accounting.org/ as to the payment of utility charges. For a tenancy on an annual basis, the amount payable annually divided by 12.

Accounting Topics

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Operating income is a metric used to determine how much of your revenue will ultimately turn into a profit after accounting for factors like taxes. Manufacturing enterprises may handle their rent costs significantly differently. These businesses incorporate rent costs as part of production overhead considerably more frequently. Regardless of the terms of the contract between the lessor and the lessee, the lenders will have the right to repossess the asset if the lessor declares bankruptcy. Even if they have made an advance payment, they don’t get to raise the asset column.

The section 467 interest for the taxable year (as defined in paragraph of this section). For instance, in situations when there is intense competition, you can offer to pay a full year’s rent in advance to get a specific apartment.