However, to be able to make a decision in which both the investor and the company are guaranteed of a win, the retained earnings past performance will be used to assess the trend. Thereafter, can they then decide whether to go for the dividends payout or opt for reinvestment for long term value. Retained earnings are reported in the shareholders’ equity section of the corporation’s balance sheet. Corporations with net accumulated losses may refer to negative shareholders’ equity as positive shareholders’ deficit. A report of the movements in retained earnings are presented along with other comprehensive income and changes in share capital in the statement of changes in equity.

On one hand, high retained earnings could indicate financial strength since it demonstrates a track record of profitability in previous years. On the other, it could be indicative of a company that should consider paying more dividends to its shareholders. This, of course, depends on whether the company has been pursuing profitable growth opportunities. https://accountingcoaching.online/ One way to assess how successful a company is in using retained money is to look at a key factor called retained earnings to market value. It is calculated over a period of time and assesses the change in stock price against the net earnings retained by the company. Since the retained earnings account is anequity account, it has acredit balance.

“Retained earnings” refers to the portion of a company’s net income that isn’t distributed to shareholders as dividends. Earnings that are retained instead of distributed to shareholders may be used for growth and expansion activities like research and development, the purchase of new plants or equipment, or hiring. Any changes or movement with net income will directly impact the RE balance. Factors such as an increase or decrease in net income and incurrence of net loss will pave the way to either business profitability or deficit. The Retained Earnings account can be negative due to large, cumulative net losses. Retained earningsare a portion of a company’s profit that is held or retained from net income at the end of a reporting period and saved for future use as shareholder’s equity. Retained earnings are also the key component of shareholder’s equity that helps a company determine its book value.

Retained Earnings Examples

If the company is less profitable or has a net loss, that affects what is retained. Earnings retained by the corporation may turn into retained losses or accumulated losses in that case. Financial modeling is both an art and a science, a complex topic that we deal with in this article. A separate schedule is required for financial modeling of retained earnings. That schedule contains a corkscrew type calculation because the current period opening balance equals the previous period’s closing balance. The closing balance of the schedule links to the current balance sheet.

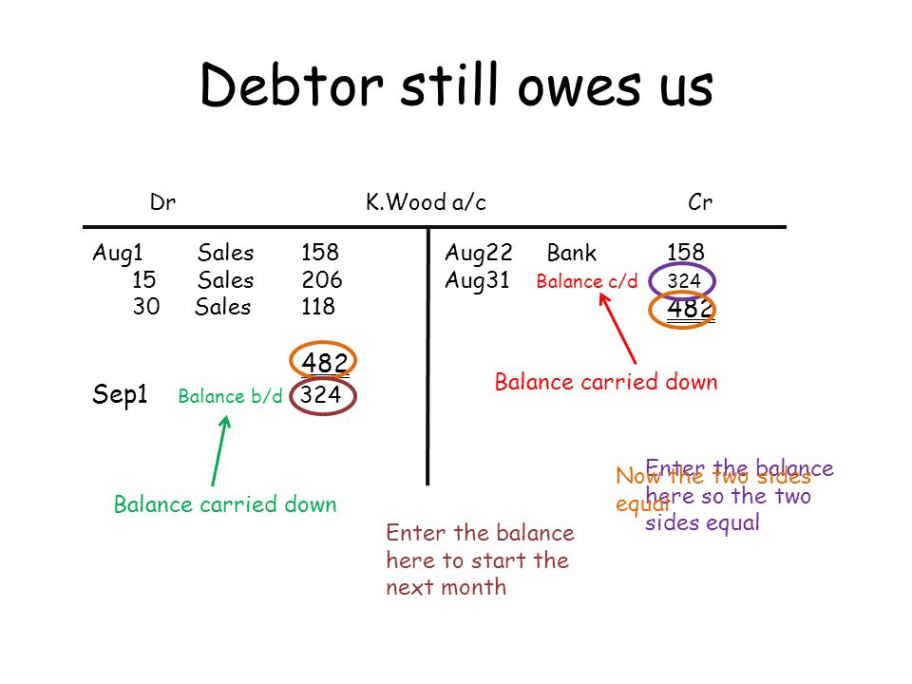

With only a few exceptions, the retained earnings account only gets credited or debited when closing out an accounting period. An example of retained earnings is when a corporation keeps of 60% of the net income and distributes the remaining 40% to the shareholders through dividends. We don’t know what their dividends are, so we’re going to use the balance sheet to calculate them. On the balance sheet, the company states that retained earnings in 2020 are $10,000. The same elements that affect net income affect retained earnings, including sales revenue, cost of goods sold, depreciation and a range of other operating expenses. Retained earnings are the portion of profits that are available for reinvestment back into the business.

What Is Net Income?

The amount of a corporation’s retained earnings is reported as a separate line within the stockholders’ equity section of the balance sheet. However, the past earnings that have not been distributed as dividends to the stockholders will likely be reinvested in additional income-producing assets or used to reduce Retained Earnings Definition the corporation’s liabilities. This is the amount of retained earnings to date, which is accumulated earnings of the company since its inception. Such a balance can be both positive or negative, depending on the net profit or losses made by the company over the years and the amount of dividend paid.

- Such items include sales revenue, cost of goods sold , depreciation, and necessaryoperating expenses.

- At the end of an accounting year, the balances in a corporation’s revenue, gain, expense, and loss accounts are used to compute the year’s net income.

- Thereafter, can they then decide whether to go for the dividends payout or opt for reinvestment for long term value.

- A retained earnings balance is increased by net income , and cash dividend payments to shareholders reduce the balance.

- Those account balances are then transferred to the Retained Earnings account.

Revenue is the money generated by a company during a period but before operating expenses and overhead costs are deducted. In some industries, revenue is calledgross salesbecause the gross figure is calculated before any deductions. In the long run, such initiatives may lead to better returns for the company shareholders instead of those gained from dividend payouts.

What Is Retained Earnings?

It involves paying out a nominal amount of dividends and retaining a good portion of the earnings, which offers a win-win. Though the last option of debt repayment also leads to the money going out of the business, it still has an impact on the business’s accounts . The income money can be distributed among the business owners in the form of dividends. Retained earnings is the amount of net income left over for the business after it has paid out dividends to its shareholders. The money can be invested in new machinery, equipment, or research with the hope of generating additional profits. Alternatively, the money can be used to lower the amount of debt issued by the company; thereby reducing the use of leverage.

After adding the current period net profit to or subtracting net loss from the beginning period retained earnings, subtract cash and stock dividends paid by the company during the year. In this case, Company A paid out dividends worth $10,000, so we’ll subtract this amount from the total of Beginning Period Retained Earnings and Net Profit. By definition, retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. It is also called earnings surplus and represents reserve money, which is available to the company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called theretention ratio and is equal to (1 – the dividend payout ratio). Retained earnings appear in the owner’s equity section of the company’s balance sheet.

Capitalized Retained Earnings Definition

Gross sales are calculated by adding all sales receipts before discounts, returns, and allowances together. Equity typically refers to shareholders’ equity, which represents the residual value to shareholders after debts and liabilities have been settled. For example, during the period between September 2016 and September 2020, Apple Inc.’s stock price rose from $28.18 to $112.28 per share. If a company does not operate profitably, there can be what is referred to as a retained loss or deficit. Retained earnings is increased periodically by newly reported net income . Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. Hence, company’s can choose how and where they would like to reinvest their earnings back into the business.

- To make informed decisions, you need to understand how activity in the income statement and the balance sheet impact retained earnings.

- Accordingly, the cash dividend declared by the company would be $ 100,000.

- This is the net profit or net loss figure of the current accounting period, for which retained earnings amount is to be calculated.

- Retained earnings appear in the owner’s equity section of the company’s balance sheet.

- They are classified as a type of equity reported on shareholders’ balance sheets.

The cash can be used for researching, purchasing company assets, marketing, capital expenditure among other activities that can support the company’s further growth. On the other hand, a company which is still growing and has a low RE may not have many choices and in most cases, it prefers distributing the dividends to respective shareholders.

How To Calculate The Effect Of A Cash Dividend On Retained Earnings?

It appears in the equity section and shows how net income has increased shareholder value. Many people in the public are often confused about what is not considered to be a retained earning and what is. Retained earnings, first of all, must be reported in the balance sheet given to shareholders. It’s not a hidden or mysterious amount that isn’t revealed when one invests in stock. It can be found easily under the shareholders’ equity section of the balance sheet or sometimes even in a separate report. This amount is also not static but frequently adjusted and evolved to react to company changes and needs.

On the balance sheet, the retained earnings value can fluctuate from accumulation or use over many quarters or years. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholder’s equity. Each period, net income from the income statement is added to the retained earnings and is then reported on the balance sheet within shareholders’ equity.

The money can be used for any possible merger, acquisition, or partnership that leads to improved business prospects. It can be invested to expand the existing business operations, like increasing the production capacity of the existing products or hiring more sales representatives. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

See For Yourself How Easy Our Accounting Software Is To Use!

For example, Custom’s gross profit for the current year is $80,000, but net income for the current period is $22,500. Businesses that generate retained earnings over time are more valuable and have greater financial flexibility. The retained earnings amount can also be used for share repurchase to improve the value of your company stock. Generally, Retained earnings represents the company’s extra earnings available at management’s disposal. In most cases, the management uses this reserve money to reinvest back into the business or give it out to settle the company’s debt.

Note that each section of the balance sheet may contain several accounts. Businesses incur expenses to generate revenue, and the difference between revenue and expenses is net income. Expenses are grouped toward the bottom of the income statement, and net income is on the last line of the statement. Thus, at 100,000 shares, the market value per share was $20 ($2Million/100,000). However, after the stock dividend, the market value per share reduces to $18.18 ($2Million/110,000).

Revenue sits at the top of theincome statementand is often referred to as the top-line number when describing a company’s financial performance. The next thing you’ll notice is that it’s a component of shareholders’ equity rather than an asset — which is counterintuitive considering it’s a big chunk of cash. While that’s true, it’s technically not the company’s cash; it belongs to the shareholders. The ending balance of retained earnings from that accounting period will now become the opening balance of retained earnings for the new accounting period. Retained earnings are the accumulated net earnings of a business’s profits, after accounting for dividends or other distributions paid to investors.

A company’s equity reflects the value of the business, and the retained earnings balance is an important account within equity. To make informed decisions, you need to understand how activity in the income statement and the balance sheet impact retained earnings. As explained earlier, profitability generated by net income increases retained earnings, and the retained earnings balance is an equity account in the balance sheet. Now that you’ve reviewed the income statement, let’s go over the balance sheet accounts in detail. Retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet.

Calculating Retained Earnings

Retained earnings mean a company’s earnings remaining in the business after paying shareholder dividends. A small business owner might encounter retained earnings when accounting for income and paying taxes. For LLCs and partnerships taxed as “pass-through entities,” the business passes its income to the owners and does not pay dividends. However, revenue doesn’t accurately represent the money that a company gets to keep and use.

Refers to funds accumulated over the life of a business and held by the business for use in operations and growth. It is reported in the Equity section of a financial statement called a Balance Sheet. So, when you look at the two individually, it can be hard to assess the financial picture for a company. It’s great if a company has high revenue, but it means nothing if that revenue doesn’t result in profits. This is when a company purchases shares back from shareholders, increasing the business’s stake in itself.